Whether you have been in the hair industry for a decade or just graduating, continuing your education will be necessary for a successful career. Many stylists are not aware that the Internal Revenue Service (IRS) provides hairstylists with the opportunity to reduce taxable income by allowing deductions for ordinary and necessary deductions.

An ordinary expense is one that is common and accepted in your trade or business such as licenses, insurance, or supplies. A necessary expense is one that is helpful and appropriate for your trade or business including continuing business cards, advertising expenses and the most important continuing education classes. Any continuing education class (as long as your employer is not reimbursing it) is eligible as a deduction on your taxes.

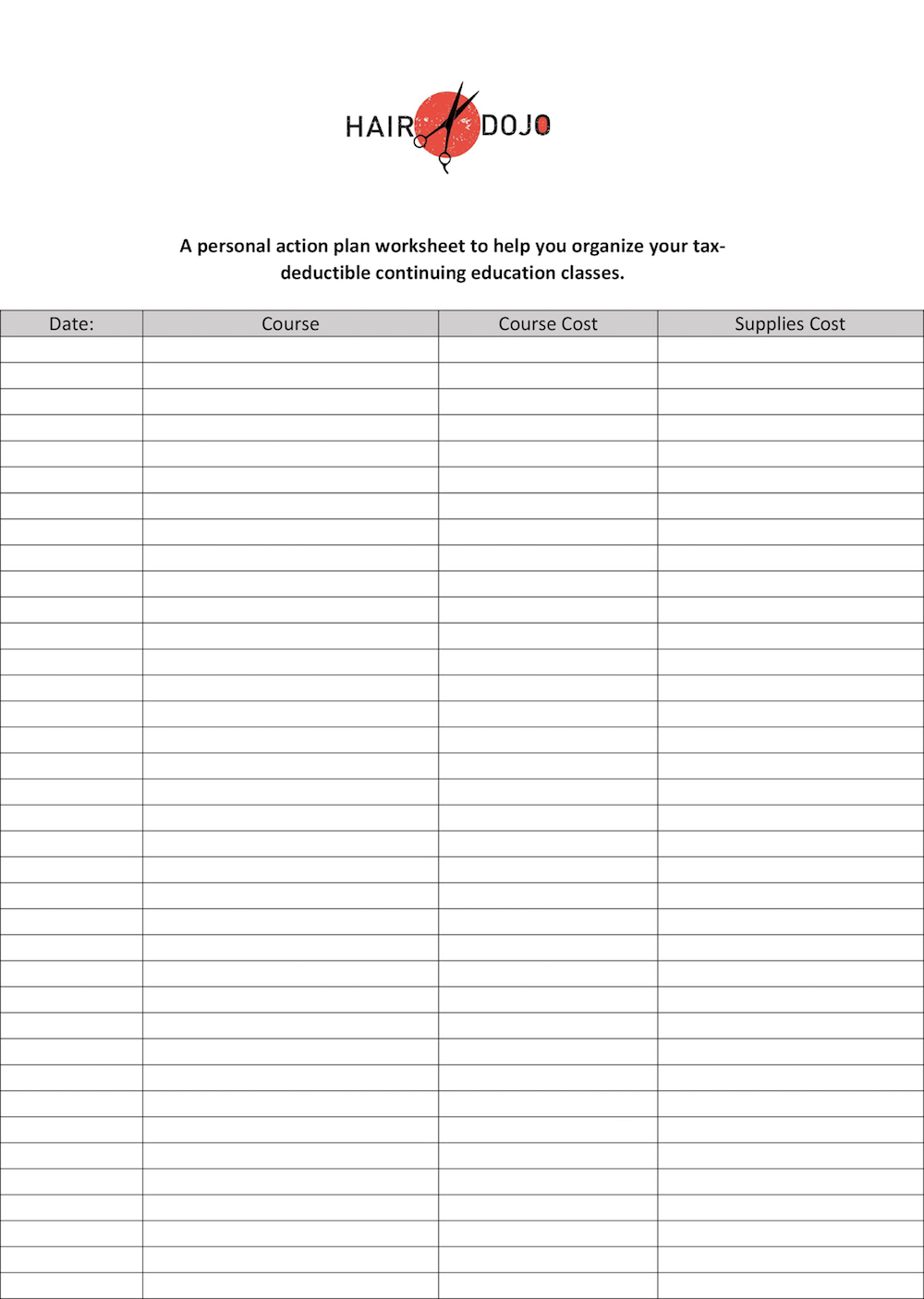

So, where to start? As hairstylists, we are more focused on organizing our client’s formulas than our receipts but a little organization could save you at the end of the year. We recommend starting a personalized expense spreadsheet at the beginning of each year and a designated spot to save all of the corresponding receipts to match the expenses you will log.

Set aside the time to enter all of your receipts into the spreadsheet whether weekly, monthly, or quarterly and you will thank yourself at the end of the year. Now, what to expense when it comes to continuing education classes. You can deduct the cost of the course fee itself and any designated materials such as books or tools required for the course. A simple checklist would include the following:

- Create a personalized expense sheet.

- Register for a continuing education class.

- Print out the digital receipt and/or course description.

- Keep all receipts for any tools/supplies purchased for the registered class.

- For each class file all corresponding receipts together.

- Log all expenses for each individual class onto spreadsheet.

A great way to organize would be to print off the course description, staple all receipts of expenses for that course file it and then log it according to your designated schedule. When the end of year comes, you will have everything organized and be able to prepare your taxes with confidence. Enhance your career by signing up for a class at HairDojo and start connecting with other professionals today!